If you make more than three day trades during (over, within) a five trading day period, Robinhood will flag you as a pattern day trader.

This means that the fourth (4th) day trade you make within a five-day period will be your last day trade for the next 90 days, unless certain criteria (covered below) are met by you.

This designation will prevent you from executing a day trade for the next 90 days, at which point the designation will be automatically removed and you can start day trading again.

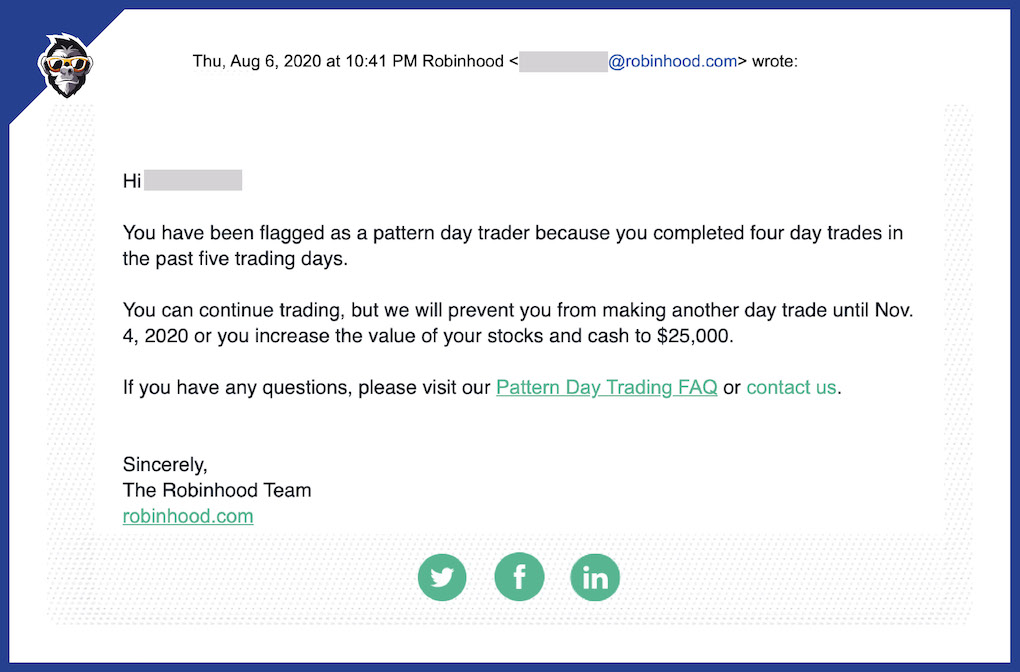

“You have been flagged as a pattern day trader because you completed four day trades in the past five trading days.” – Robinhood, Email to a member flagged for pattern day trading

Yep, that’s me:

This article covers everything you need to know about pattern day trading on Robinhood: When and why it happens, whether you can get around it, and how long the restrictions last.

(Robinhood offers investors the choice of turning on “Pattern Day Trade Protection,” which you can read about here.)

But first, the definitions that matter

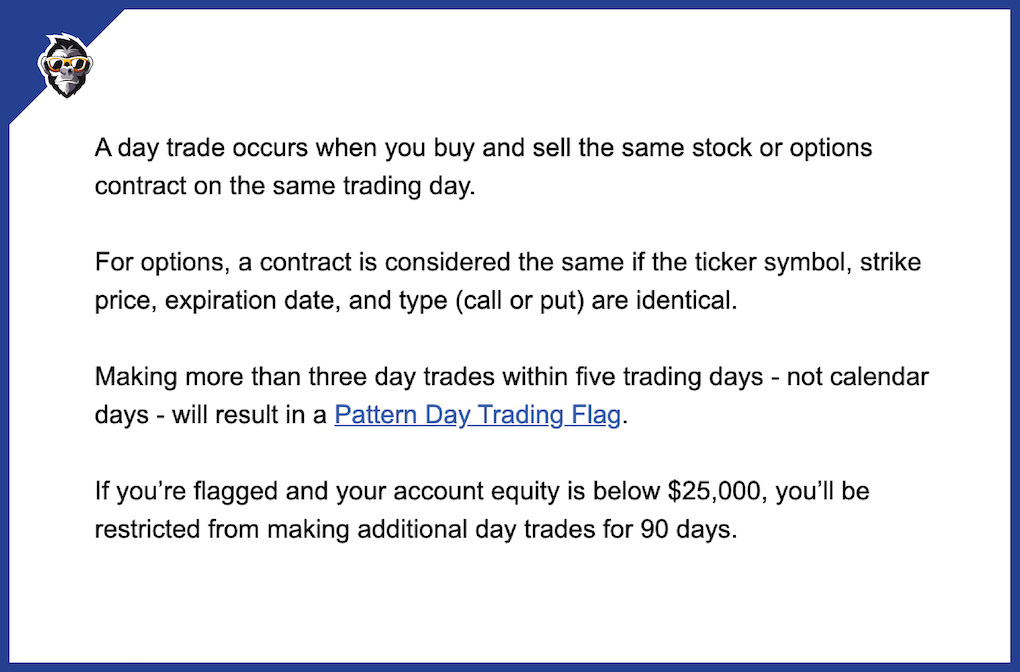

- Day Trade: Buying AND selling a stock or an option on the same day. If you were to buy one or more shares of AMD stock or an AMD option in the morning and then sell the same stock or option later that afternoon, that would be considered one day trade. But if you’d bought that same stock or option on Monday and then sold it Tuesday, that would not be a day trade, since the buying and selling happened on two different days.

- Trading Day: Any day that the stock market is open: Monday, Tuesday, Wednesday, Thursday and Friday are trading days; Saturday and Sunday are not. When it comes to counting day trades and/or being marked a pattern day trader, Friday comes before Monday and the five-day period is continuous, i.e., the five-day period does not reset on Monday. (Note that the SEC actually uses the term “business days,” not trading days, and that if the stock market is closed for the day due to a holiday, there is no trading day.

Why was I marked a pattern day trader on Robinhood?

If you execute 4 day trades over a 5-day period, Robinhood will mark you a pattern day trader. You will be unable to do any additional day trades for the next 90 days. You can still buy stocks, options, and cryptocurrency as usual, but you will not be able to sell what you buy on the day you bought it.

What happens when I’m marked a pattern day trader on Robinhood?

Nothing much, though you’ll be unable to day trade on Robinhood for the next 90 days. Robinhood will send you an email that says, “You have been flagged as a pattern day trader because you completed four day trades in the past five trading days.

“Just purchasing a security, without selling it later that same day, would not be considered a day trade.” – FINRA.org

“You can continue trading, but we will prevent you from making another day trade until Nov. 4, 2020 [90 days after the rule was enforced] or you increase the value of your stocks and cash to $25,000.” – Robinhood

Will being marked a pattern day trader on Robinhood affect my other brokerage or trading accounts?

No. Because the pattern day trading rule is enforced at a brokerage level (“the firm,” as FINRA lays out here), being marked a pattern day trader on Robinhood will not prevent you from day trading elsewhere.

“The day-trading margin rule applies to day trading in any security, including options.” – FINRA.org

Can you get around the pattern day trade flag on Robinhood?

No, you can not bypass being marked a pattern day trader on Robinhood unless you do so in one of the two following ways:

- Wait out the 90-day period, or

- Bring the balance of your account up to $25,000 or more (between cash and securities—stocks, options, etc.)

Outside of 1 and 2 above, Robinhood customer services can do nothing to restore your ability to day trade if you were marked a pattern day trader.

By marking you a pattern day trader, Robinhood is not setting its own rules, but is merely enforcing existing rules as laid out by FINRA.

Having $25,000 across multiple accounts or brokerages will not qualify; you would need to have $25,000 in the Robinhood trading account from which you are trading.

You can also downgrade your Robinhood account into a “cash account,” but doing so will prevent you from trading options and increase the time you have to wait between trades, since in a cash account, no money is lent to you on margin and every trade you make has to actually settle before the money you had tied up in it becomes available again.

(In a Robinhood Level 2 account, Robinhood is loaning you money between trades, as well as after you make an “instant deposit” from your bank account, and money becomes usable by you before it is truly back in your account.)

Robinhood controls their application of the Pattern Day Trading Flag, but pattern day trading rules are actually established by FINRA and enforced by the SEC, which states: “Executing four or more day trades within five business days = ‘pattern day trader.’” – SEC.gov

If Robinhood marks you a pattern day trader, no Robinhood employee will be able to remove that restriction unless you: a) Downgrade your account into a cash account, b) Bring your brokerage account balance up to $25,000+, or c) You wait 90 days.

If you meet either of criteria (b) or (c) above, your account will automatically be reenabled for day trading and speaking to an employee will be unnecessary once those requirements are met.

Options Trading and the PDT Flag on Robinhood

For options, a trade is considered the same if the ticker symbol, strike price, expiration date, and type (call or put) are identical.

Making more than three (3) day trades on options within five trading days—not calendar days—will result in a Pattern Day Trading Flag. This means that the fourth options day trade will mark you a pattern day trader.

Day Trading Isn’t Profitable for Most People

Day trading is high risk and day traders typically lose plenty of money—more than they make, in 90% of cases. The system of day trading relies on attempting to profit from very small movements in the stock market and in order to effectively do so, you need plenty of money or capital in the market.

Thus, when trades go wrong, you could lose a lot of money, since so much money is exposed and subject to the whims of the market.

The “Option Monkey Method” doesn’t use, rely on, or suggest that anyone day trade options consistently. However, it is nice to be able to fall back on the ability to sell a call option just bought earlier in the day (i.e., to perform a single day trade), in the event that you believe any obtained gain is unlikely to hold into tomorrow.

The “Option Monkey Method” is also not actually a ‘method’ of anything, but a proper noun used only to establish a subtopic within the broader field of options for the sake of explanation.

Option Monkey also doesn’t provide financial advice of any kind whatsoever, and readers are 100% responsible for how they choose to use any opinions/information shared.

Example of Being Flagged a Pattern Day Trader on Robinhood

The following is an example of an options trader being flagged as a pattern day trader by Robinhood. In summary, the trader (that’s me) did both the buying and the selling of a call option on Facebook stock four times in one day.

Table of Trades Involved ($FB Calls, Aug. 6, 2020, PST):

| Time | Order Type | Cost & Position | # Day Trades |

| 7:22 AM | FB $262.5 Call 8/7/2020 Buy | 1 Contract at $0.11 | – |

| 8:01 | FB $262.5 Call 8/7/2020 Sell | 1 Contract at $0.30 | 1 |

| 8:32 | FB $275 Call 8/7/2020 Buy | 1 Contract at $0.22 | – |

| 8:32 | FB $290 Call 8/7/2020 Buy | 1 Contract at $0.07 | – |

| 8:52 | FB $275 Call 8/7/2020 Sell | 1 Contract at $0.44 | 2 |

| 9:00 | FB $290 Call 8/7/2020 Sell | 1 Contract at $0.14 | 3 |

| 9:27 | FB $300 Call 8/7/2020 Buy | 1 Contract at $0.08 | – |

| 6:59 AM | FB $300 Call 8/7/2020 Sell | 1 Contract at $0.08 | 4 |

What’s wrong with this series of trades?

These trades were done right after the account was nearly emptied for a downpayment, leaving about $40 behind. So there isn’t much to work with in terms of options contracts. The sales were done when they were to “lock in profits,” but in hindsight, the first call could simply have been held through 9:00am and sold just once, when the last of the trades was done. That would have been more profitable, prevented a pattern day trading flag and restriction.