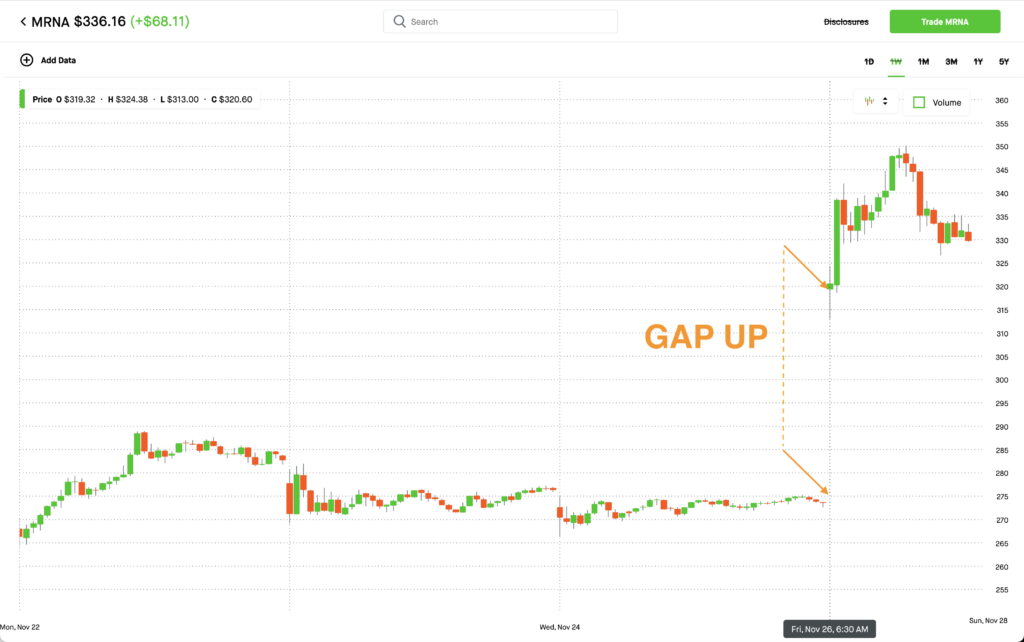

Gap Up Defined:

A “gap-up” occurs when the opening price of a stock is significantly higher than the stock’s closing price on the previous trading day.

A gap-up usually refers to a “significant” increase over the prior day’s price, and thus would be relative to the going rate of the stock or options contract.

As an example, if at market close on Monday, a share of $AMD stock was worth $151.34, and then at market open on Tuesday it was worth $158.20, you could say AMD “gapped up.”

Had it opened on Tuesday morning at $151.50 (at plus $0.16 cents), you wouldn’t say it gapped up, but if a different stock worth $2.00 had opened the following day up $0.16 cents, that may qualify as a gap up. Because in the latter example, an overnight gain of $0.16 represents a larger percent of the $2.00 stock’s value than it does for a stock valued at $150-plus.

So a gap up is relative to the stock’s overall price and the word is usually only used to refer to a significant increase in price.

What Gap-Up Doesn’t Mean

Gap up doesn’t cover price action that occurs during the day—if a stock price spikes nicely after the release of some news mid the trading day, it has certainly risen but it has not gapped up.

Gap-Up in Application

- In options trading–particularly short-term call options trading—a gap-up will usually result in your options contract becoming much more valuable ‘overnight,’ and it may even end up in the money. [Conversely, a “gap-down” could leave your call option so much less valuable, since the gap down now puts your strike price so far away.]

- To capitalize on a “gap-up” a trader would have to have an open position in that stock—he or she would have to be then holding stocks or options in order to benefit.

Gap-Up in Sentences

- “Microsoft gapped up so I started today green and in the money.”

- “So you’re counting on $PYPL to gap up on this news?”

Gap-Up in the Option Monkeys’ Method of Swing Trading

Gap up plays no particular role in one person’s method of swing trading call options. That means no trades are made based solely on a gap up or gap down or the anticipation of one, aside from the possibility that one may occur around earnings calls.

It does help to be aware of the fact a call option can lose all of its value if a gap down occurs, since the share price may not recover (rise) before the option’s strike date (expiration date) and that a call option can gain significant value if a gap up occurs.