Robinhood offers option traders the ability to prevent themselves from unknowingly or accidentally triggering a Pattern Day Trader Flag that would cause them to lose their ability to day trade for 90 days.

Follow these seven steps to turn Pattern Day Trade Protection on or off on Robinhood.

- From the homescreen of your Robinhood app, click your profile icon in the bottom right corner of the screen.

- In the menu that now shows up, click “Investing” at the top.

- Scroll to the bottom of the “Investing” screen.

- Click on “Day Trade Settings” in green lettering.

- Click the slider to turn PDT protection on.

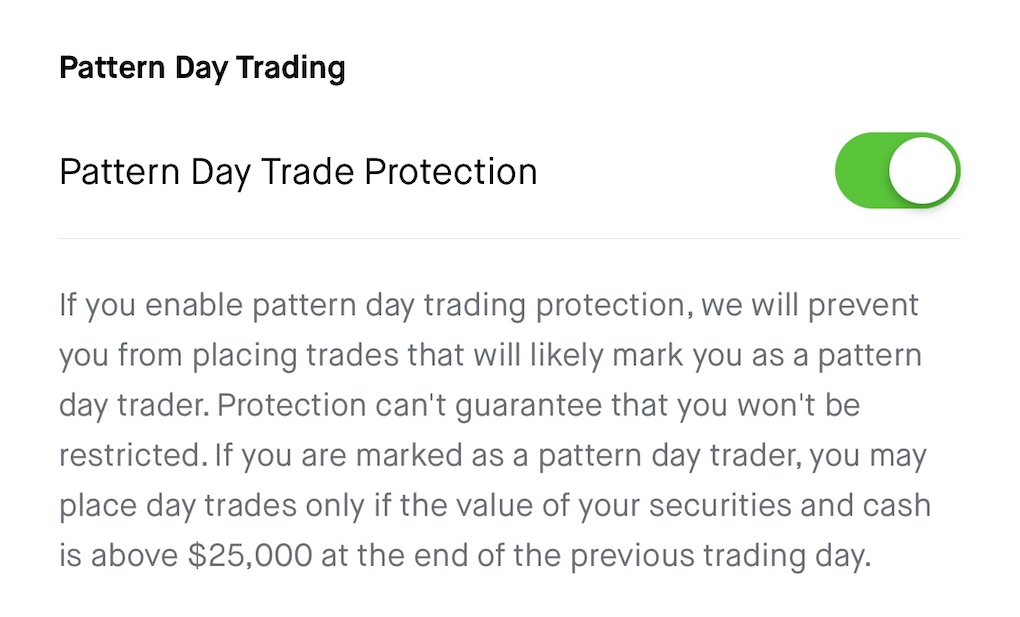

- When PDT protection is on, the slider (or button) turns green.

- Robinhood will now prevent you from executing a day trade that would trigger a pattern day trading flag, which if received, would prevent you from executing any day trades for the next 90 days. (See explanation following steps 1-7 below for more information on this.)

“If you enable pattern day trading protection, we will prevent you from placing trades that will likely mark you as a pattern day trader.” – Robinhood

What does turning on Robinhood PDT Protection do exactly?

Pattern Day Trade Protection on Robinhood prevents an investor from executing a fourth day trade within a five trading day period.

Were the investor to execute a fourth day trade in five days for whatever reason, they would be flagged as a pattern day trader and would lose their ability to day trade for the next 90 days.

(An investor with $25,000 or more in their account—between cash, stocks, options, or other securities–is not subject to this rule. Consult a licensed financial advisor should you have questions. OptionMonkeys.com does not provide investment or other advice of any kind.)

Robinhood puts it as follows, as seen in the screen shot below: “If you enable pattern day trading protection, we will prevent you from placing trades that will likely mark you as a pattern day trader. Protection can’t guarantee that you won’t be restricted. If you are marked as a pattern day trader, you may place day trades only if the value of your securities and cash is above $25,000 at the end of the previous trading day.”

Day Trading is Not Profitable for Most People

Day trading is not at all a core part of my investment strategy and I wouldn’t recommend it to anyone interested in learning options trading.

Not as a first step at least, if at all.

However, it is a nice–and often necessary—fallback to have the ability to be able to day trade for those few to several trades that do not go as planned.

Specifically, I find it worth selling an options contract on the same day I purchased in the event that that option has risen well above what I believe its price or value will be at market open the following day.

I consider selling the option if it greatly outperforms my anticipated projections because any “gain” is only theoretical until the option is sold and profits are actually realized.

Thus day trading may occasionally be the right call depending on market conditions, and your own due diligence and decisions.