This is a step-by-step walk-through of an actual options swing trade we did on Robinhood.

I’ve laid it out like this with so many screenshots and a timeline of key events because it’s something I think would have been really helpful while I was trying to learn options.

INVESTING in the stock market is slow and simple for non-professsional investors, but TRADING options is faster-paced and requires much more attention at times — everything here happened in just over 24 hours:

What Was Traded:

| Stock: | Intel ($INTC) |

| Position: | 12 calls |

| Time Held: | ~ 28 hours |

| # of Buys/Sells: | 3/3 |

| Risk: | $168 |

| Return: | $1,005; +498% |

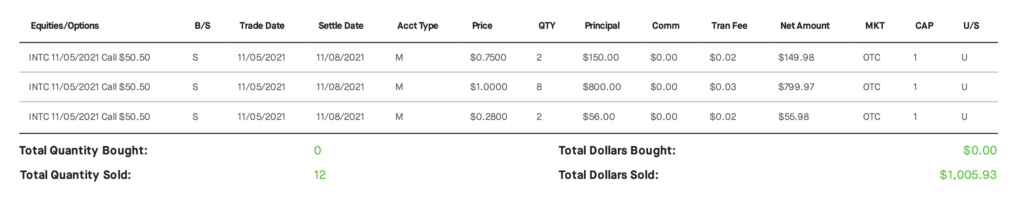

Table of Trades Involved:

| Buy | Nov 4, 2021, 6:30 am | 5 calls @ $0.18 = -$90 |

| Buy | 6:34 am | 1 call @ $0.12 = -$12 |

| Buy | 6:46 am | 6 calls @ $0.11 = -$66 |

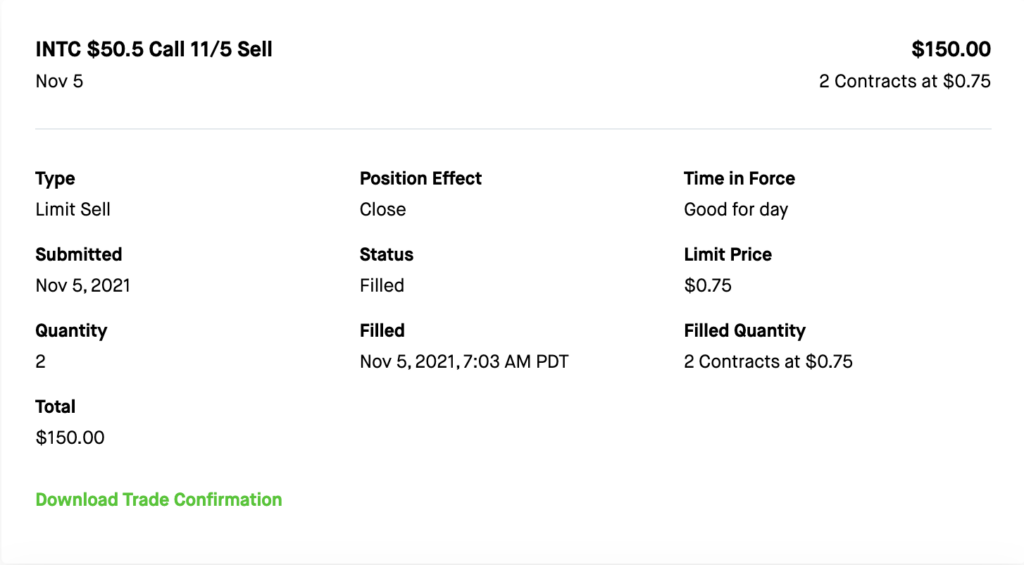

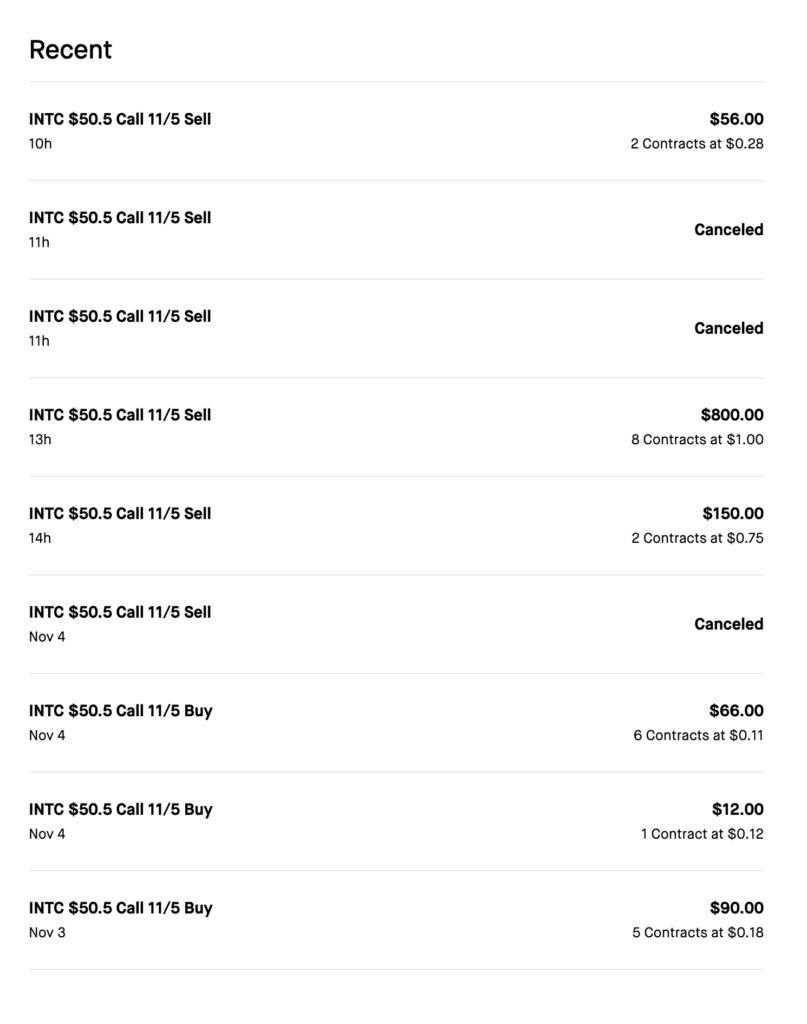

| Sell | Nov 5, 2021, 7:03 am | 2 calls @ $0.75 = +$150 |

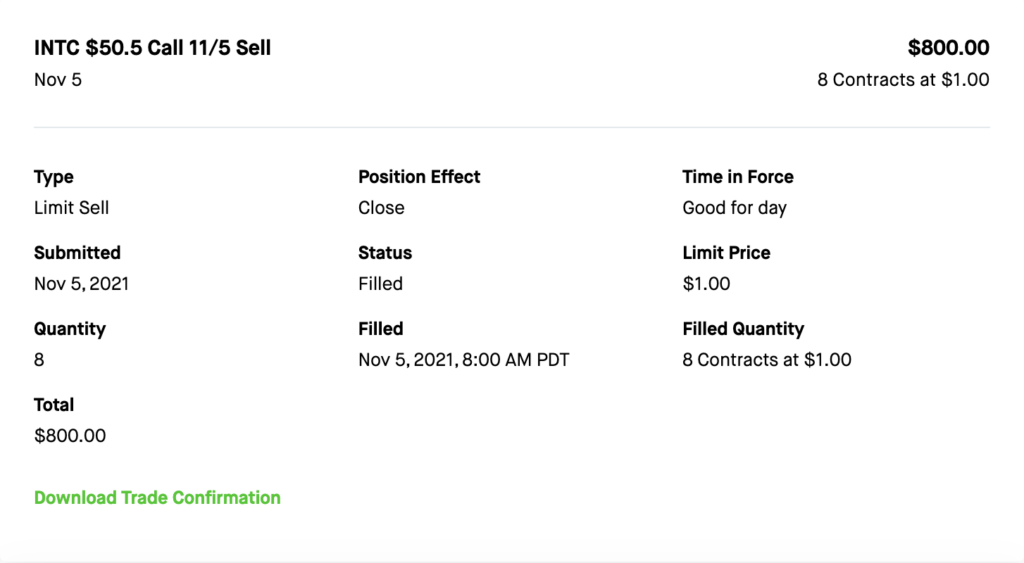

| Sell | 8:00 am | 8 calls @ $1.00 = +$800 |

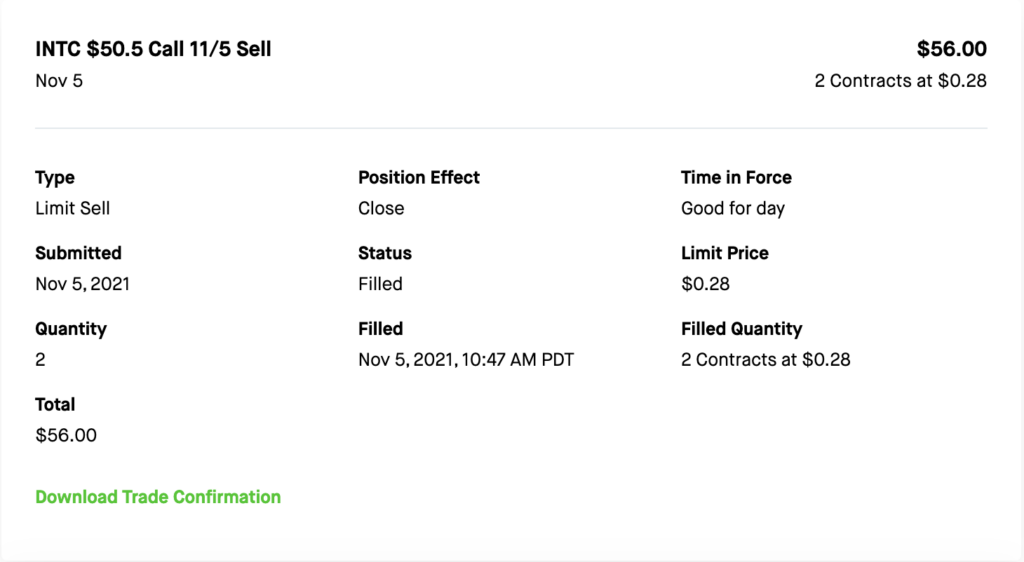

| Sell | 10:47 am | 2 calls @ $0.28 = +$56 |

| = | Net Risk: $168 | Net Return: $1,005 |

Educational purposes only. Not financial advice. Reader alone is responsible for all actions taken or not taken and any subsequent gain or loss incurred. Options trading is high-risk and may not be suitable for all. Consult a licensed financial professional. Website doesn't provide finance or investment advice, nor is it licensed to do so.

Step-by-Step Options Swing Trade:

Weds., Nov 3, 2021

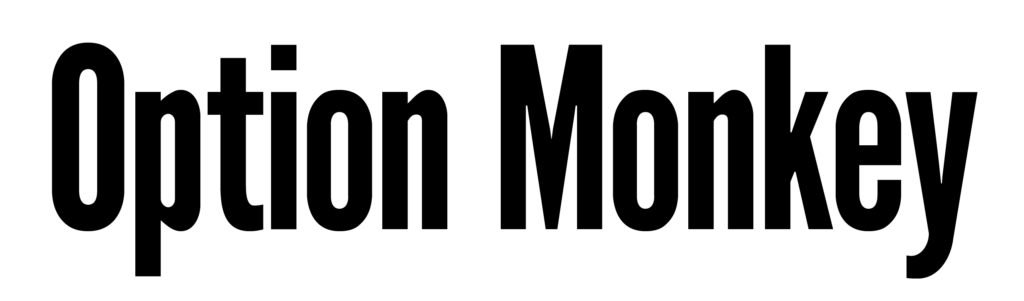

1. 1:18PM • Order for 5 Call Options Placed After Market Hours

“INTC 11/05/2021 Call $50.50.” This designation (at left) means we purchased a Call Option on Intel stock that expires on November 5th and has a strike price of $50.50.

If the “underlying asset” (the Intel stock) fails to reach above the $50.50 mark by November 5, our call option contracts will likely expire useless. (Unless (a) We sell them before then, or (b) Another change occurs in the market that is beyond the scope of this simple explanation.)

Thurs., Nov 4, 2021

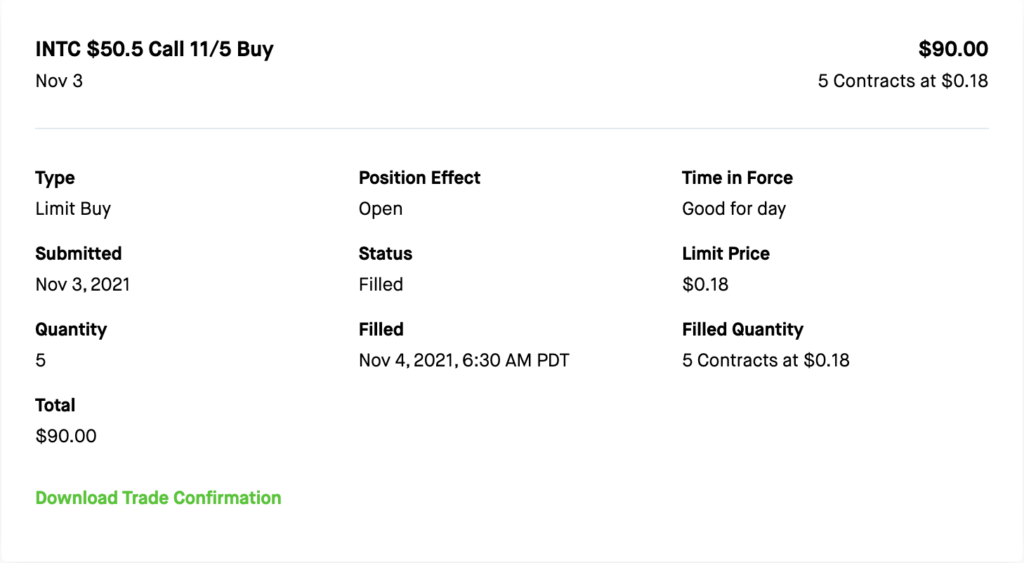

2. 6:30AM • Order Fills at Market Open (Los Angeles time)

Our order for these five call options contracts is automatically filled the following morning, when the price we said we would pay for these options—$18.00 each—is “agreed on” (reached) by the stock market.

Notice below the words “Limit Price” in the third column. This indicates that as the call option buyer, we set a specific price ($0.18, or $18.00 per call option) we were willing to pay. If the market opened today and the call option was already valued at above $18, our order would go unfilled. If you’d like your order filled even if a certain price point isn’t met (such as our $18.00 above), you will have the choice to do so.

- Pro: Your order will be filled.

- Con: You have less control over what you pay for your call option.

3. 6:44 AM • Our 5 Call Options Each Lose 35% of Their Value

Fifteen minutes after our order was filled, our call options are down 35%. Panic!

“Some people see gains and sell. Some people see losses and sell. Neither is wrong, but if you do a bit of both, you will end up only limiting your gains and securing your losses.”

In reality, faced with this scenario a trader can do one of three things:

- Exit his position. I.e., Sell the call options. A “Stop Loss” can be set to do this automatically. I don’t personally recommend setting a stop loss on call options contracts, but a trader may find it suits their trading style.

- “Average Down.” I.e., Now that the stock/options contract is dramatically less expensive, you could buy more for less money, thus reducing your “Avg Cost” as seen in the righthand column below.

- Do nothing. (In an !@# earlier article !@#, I recommend that beginning traders do little to nothing during the first hour or two after market open due to volatility.)

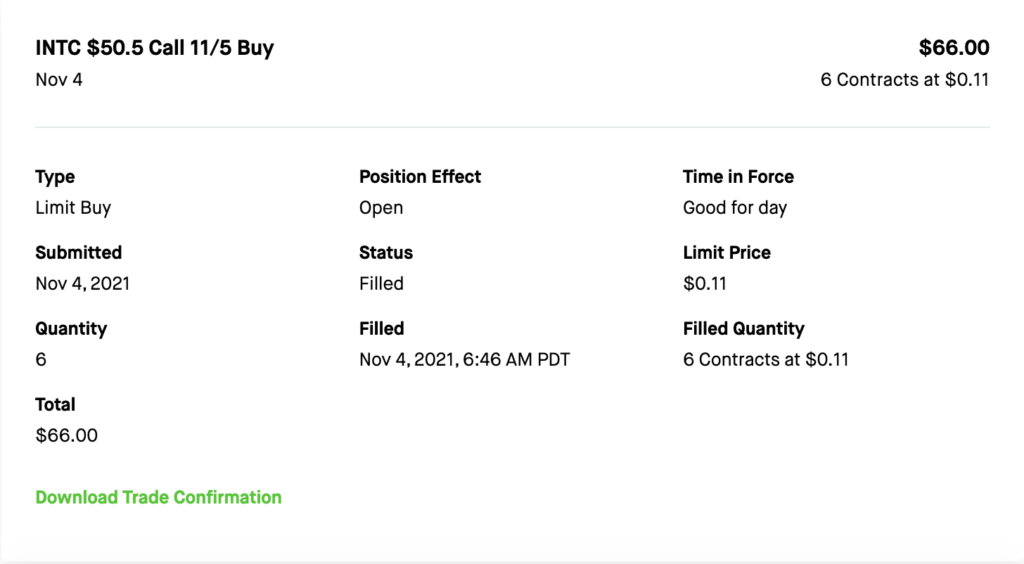

4. 6:46 AM • Position Size Doubled. “Averaging Down” By Buying 7 More Call Options

Of the three choices given above, I chose to average down and more than double the size of my position from five call option contracts to 12. It proved effective, however, it is also worth noting (not to my ego, but to your own trading choices when faced with that early morning volatility) that the original batch of five calls would have been profitable if merely left alone.

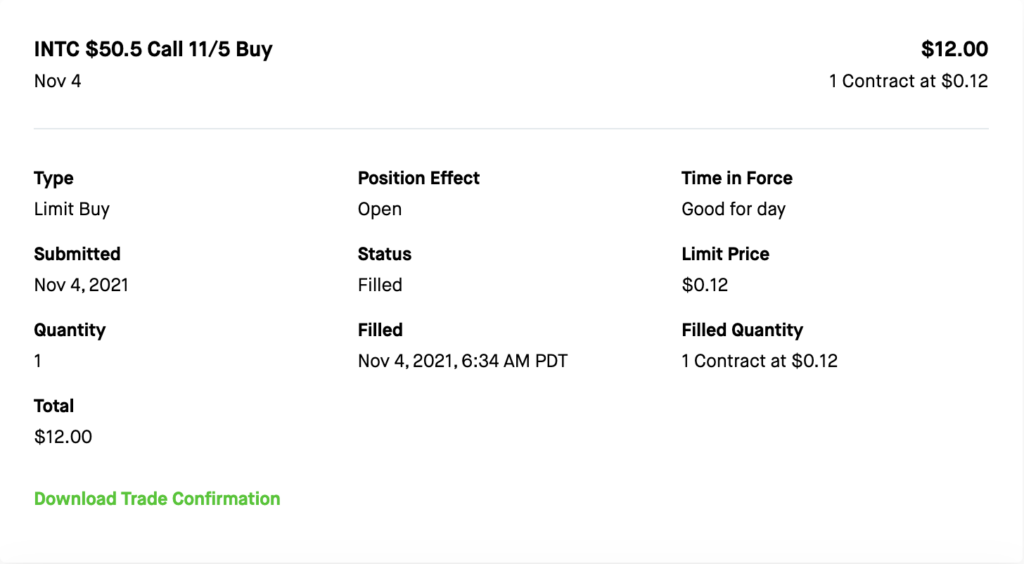

(Buy +1 Call Options for $12.00)

(Buy +6 Call Options for $11.00 each)

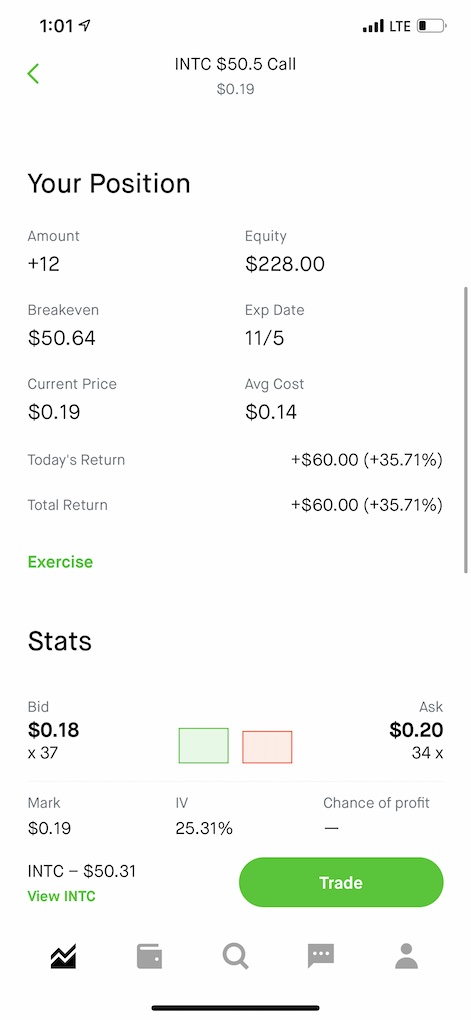

5. 1:00 PM PST • Trading Day Ends. Our 12 Call Options Are +35% (+ $60)

6. 7:00 PM • Keeping Abreast of Intel After Hours

Fri., Nov 5, 2021

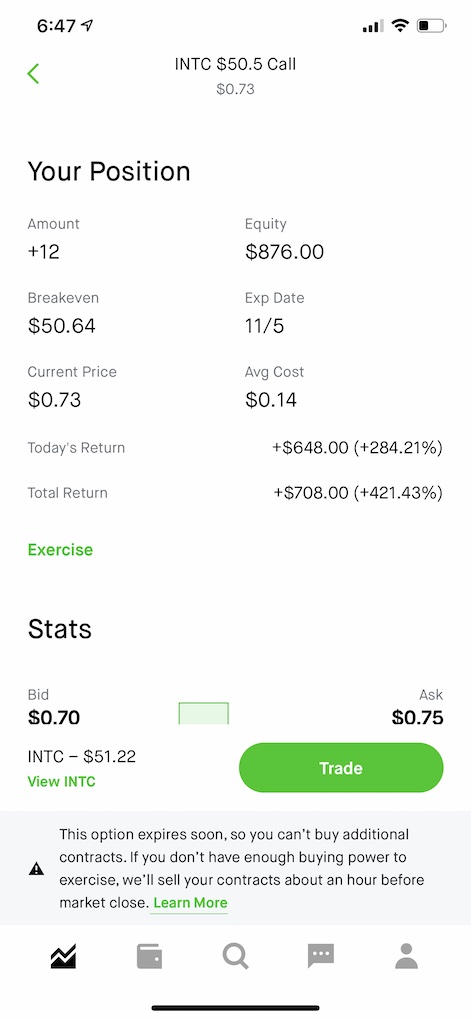

7. 6:47 AM • Wake Up to a 421% Return (+ $708)

I believe that due diligence and using the most logical approach one can come up with—even if untrained in technical or fundamental analysis—can help a trader to weigh success greatly in their favor and give a competitive edge.

I should also note that I don’t personally sell when I see a gain of 15 – 35 percent because I “don’t care for it” (relative to what can be made in an options trade.) I entered the trade looking for, ideally, a several hundred percent gain. The money I risk into the trade is already more or less written off.

In other words, I prefer to risk entirely losing a few hundred dollars on a well-thought-out trade. I consider a trade a true loss or failure if I violated my own ‘rules’ of trading—not if I stuck to them and still failed to profit.

8. 7:03 • Sell Just Enough of the Calls to Remove Our Risk From the Trade (+ $150)

We put $168 into this trade so far and it’s doing fantastic. We sell two of our 12 call options in order to remove virtually all risk from the trade. A 421 percent return is great, but we leave the remaining 10 call options to ride.

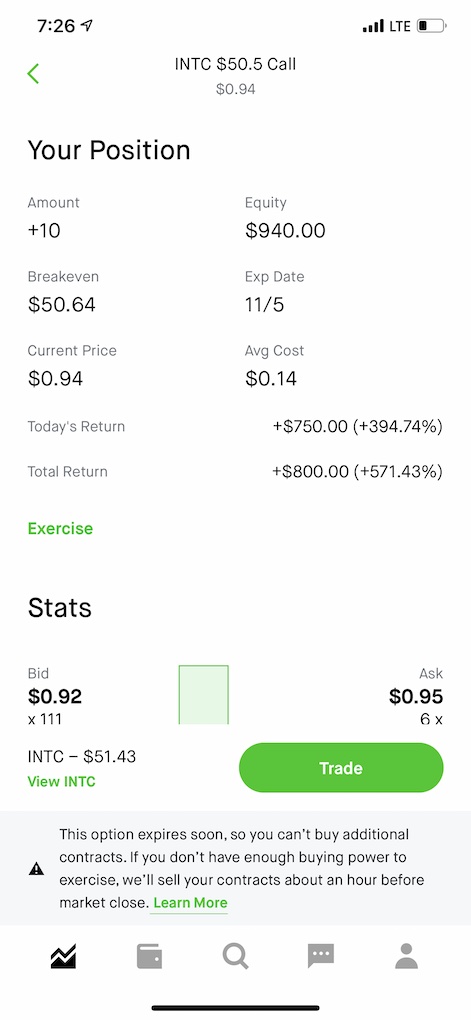

9. 8:00 AM • Watch the Bid/Ask Spread Dance, and Scan StockTwits, Google Finance

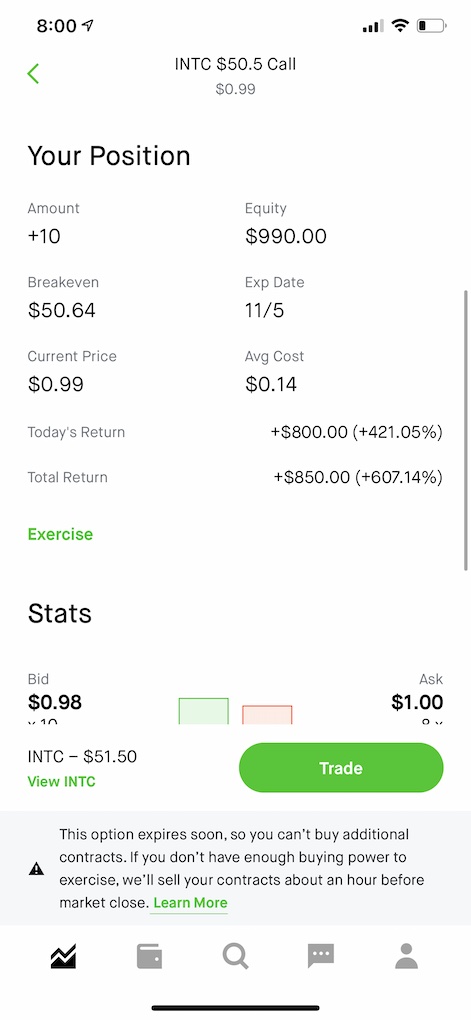

10. 8:00 AM • Sell 8 of Our Remaining 10 Calls at 607% (+ $800)

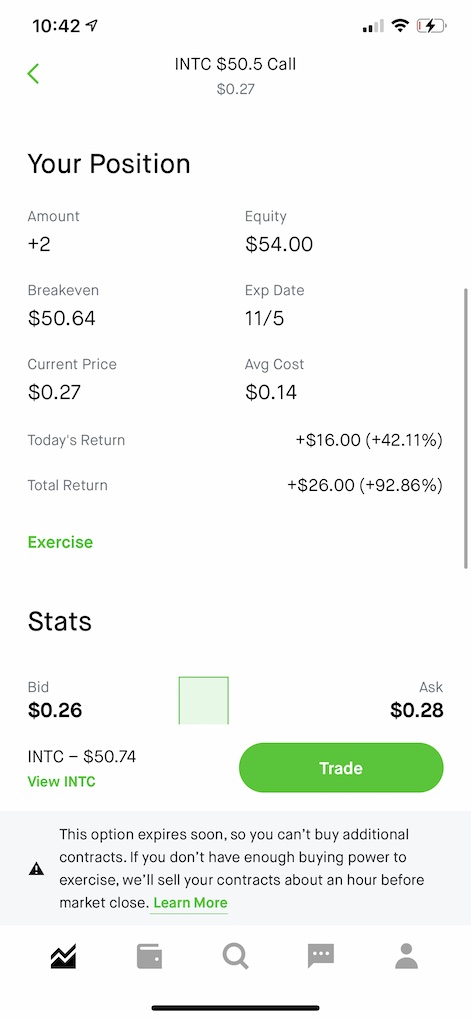

11. 10:47 AM • Sell the Remaining 2 Calls at 92.86% (+ $56)

We had left two call options in play in order to catch any additional upside. Instead, the stock progressively dipped throughout the morning. At 10:45 it was no longer worth checking in occasionally for the last few dollars from the trade so we set a sell order to end the trade.

Risk v. Return: -$168 / +$1,005

Alternate Trading Scenarios

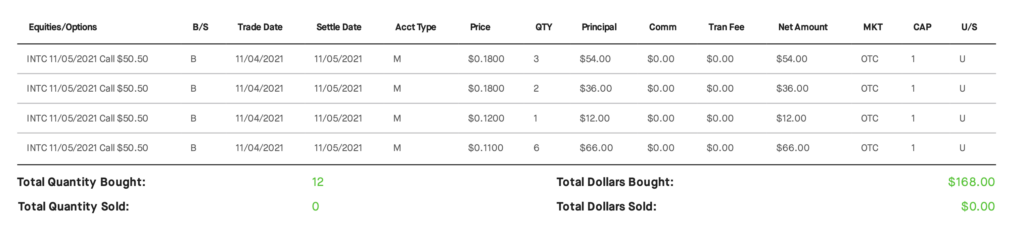

We bought our 12 call options contracts at 3 different times and prices, for a total of $168.

- First, we bought 5 calls for $18.00 each

- Second, we bought 1 more call for $12.00

- Third, we bought 6 more calls for $11.00 each

- Had we purchased all calls upfront, and not averaged down, we would have spent $216.

- Had we purchased all call at $11.00, we would have spent $132.

We also sold our 12 call options contracts at 3 different times and prices, netting $1,005.

- Had we sold all 12 calls in the 1st sale (for $75), our return would have been $900.

- Had we sold all 12 calls in the 2nd sale (for $100), our return would have been $1,200.

- Had we sold all 12 calls in the 3rd sale (for $28), our return would have been $336.

Of course, this is an essentially useless piece of information, except that it helps us understand the concept of “averaging down.”

The rightness or wrongness of this trading sequence and the decisions made is only possible to see after the fact, however, it is mentioned simply to suggest the importance of understanding an options position you’re holding relative to the state of the stock and market.

Did we get “lucky”?

Sure, I guess. But due diligence, finding catalysts, having trading rules in place, not trading more than could be comfortably lost, and having a plan for this particular trade definitely helped.

Options Swing Trade Summary:

Thursday: Buy 12 call option contracts for $168

Friday: Sell 12 call option contracts for $1,005

Note the 3 Canceled Sell Attempts

During the period of more intense activity on Friday morning, 3 sell orders were placed that I then cancelled as it became apparent that those price points were unlikely to be met.

My Opinion in Summary

This was a fun and profitable trade that fit my trading style. Would others have managed it differently or better? Most likely. Could more experienced traders poke holes in the logic used? Certainly. But in my opinion, we did well and had a great time. And that’s all any of this is: My opinion and experiences laid out in a way I think I would have found helpful while trying to understand call options.